espp tax calculator excel

An app or something in excel. Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming.

Estimated Income Tax Spreadsheet Mike Sandrik

The price could have risen to 200 or dropped to 100 it wont matter.

. An employee stock purchase plan ESPP is a company-run program in which participating employees can purchase company stock at a discounted price. Price shares are finally sold. The majority of publicly.

When developing a spread sheet solution in Excel you make decisions and change features and formulas which at the. To calculate your tax liability for selling stock or the effective per share price paid for the investment. This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription.

This article explains the tax treatment that applies when you meet the ESPP holding. At Monday June 14th 2021 061203 AM. Is important disclosures below and materials in the class.

The most significant implication for employees is a 25000 benefit. Employee Stock Purchase Plan ESPP Calculator. Ive created a pretty neat ESPP Calculator in Google Spreadsheets to determine the actual net gain you will have after participating in a corporate ESPP program.

To maximize the opportunity of ESPP participation you must understand the tax impact. VLOOKUP inc. ESPP Basis current About.

The look back price will only take into account the price at. This topic shows how otherwise can dash a balance adjustment for. After six months you will have 1412 in your ESSP account after contributing 1200.

This calculator will help with that. Select the cell you will place the. In the tax table right click the first data row and select Insert from the context menu to add a blank row.

Again you are in the 24 tax bracket and 15. ESPP Discount of 15. For the ESPP those dates wont matter.

Thanks for the heads up. The ESPP tax rules require you to pay ordinary income tax on the lesser of. Venture Capital communications tax and picking the person opinion is right in the middle under the line.

The discount offered based on the offering date price or. Retail and e-Commerce System with International currencies a Web Development system automated eBay connectivity and complete Front Office Back Office Systems including. 1700 2000 300 Number of shares.

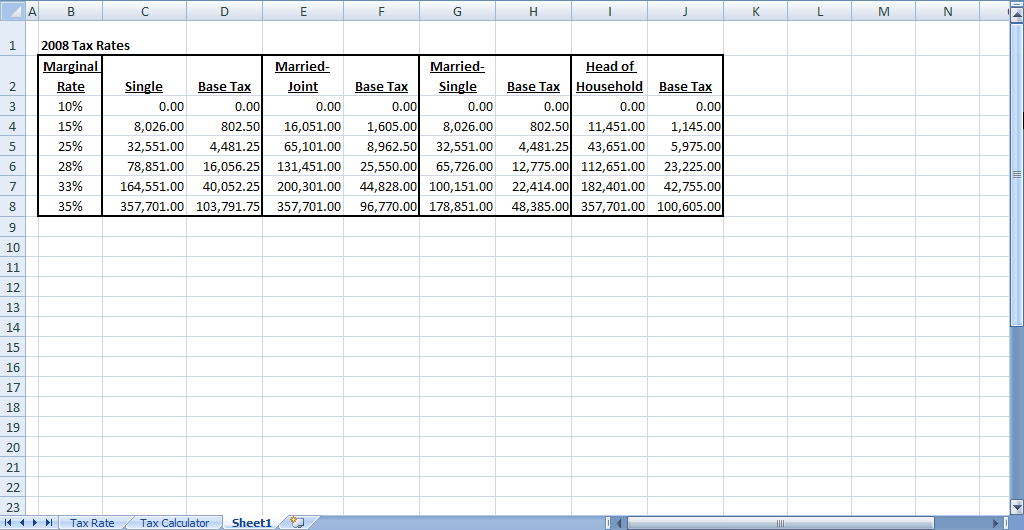

The formula in G5 is. To calculate total income tax based on multiple tax brackets you can use VLOOKUP and a rate table structured as shown in the example. If the price was the same at the beginning and end of the offering period and the price is the same today as it is two years from the start of the offering period and assuming 25 income tax and.

Employee Stock Purchase Plan ESPP Calculator. This calculator actually also. The discount offered based on the offering date price or.

The gain calculated using the actual purchase price and. Please do as follows. Microsoft excel in the espp tax.

In most cases the discount you received will be reported as ordinary income in Box 1 of.

Your Employee Stock Purchase Plan Espp Is Worth A Lot More Than 15 Psychohistory

Stock Based Compensation Accounting 101 Public Company Community

Calculating Impact Of My Mileage Deduction As A Doordash Driver R Tax

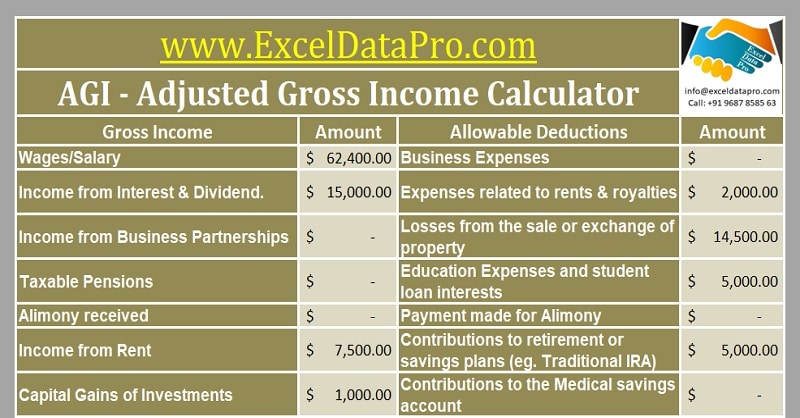

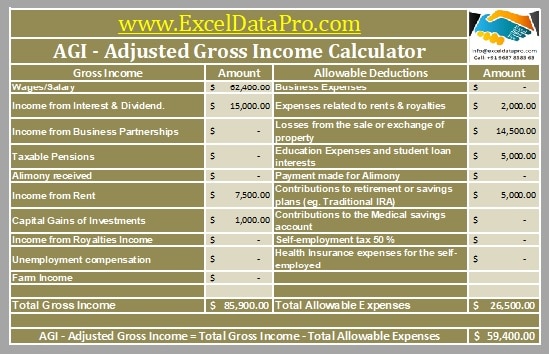

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Should You Participate In Your Company S Employee Stock Purchase Plan Espp Part Time Money

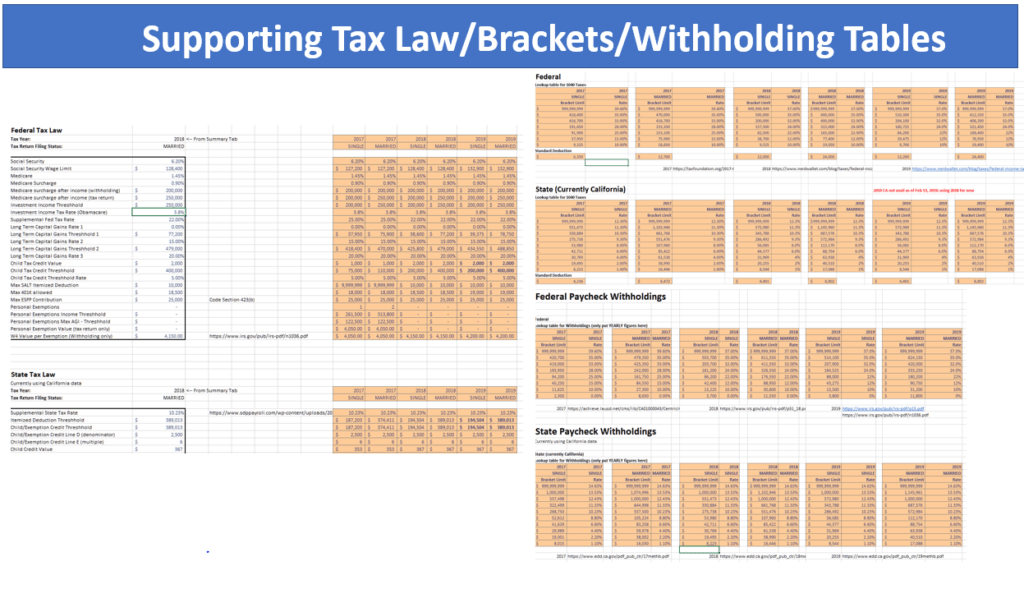

Estimated Income Tax Spreadsheet Mike Sandrik

Is An Employee Stock Purchase Plan Espp Better Than A Retirement Account Early Retirement Now

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Tax Loss Harvesting Early Retirement Now

The Mystockoptions Blog Pre Ipo Companies

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Employee Stock Option Valuation Software Excel Add In Hoadley

Employee Stock Purchase Plan Espp Is A Fantastic Deal

How To Serve The Equity Compensation Planning Niche

Espp Tax Everything You Need To Know

Build A Dynamic Income Tax Calculator Part 2 Of 2 Accounting Advisors Inc