prince william county real estate tax due dates

The board voted unanimously to defer payments for the first half of annual real estate taxes originally due today July 15 -- until Oct. Personal Property Taxes and Vehicle License Fees Due.

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

. First-half Real Estate Taxes Due. Prince william county real estate tax due dates Wednesday July 6 2022 Edit First Pageland Lane Data Center Plan 7 900 000 Square Feet Headlines Insidenova Com. Make a Quick Payment.

Effective July 1 2022 any business where food andor beverages are prepared and served to customers must remit a 4 food and beverage tax to the County. Report a New Vehicle. A convenience fee is added to payments by credit or debit card.

Second-half Real Estate Taxes Due. Tax Relief for the Elderly and Disabled Mobile Homes Application Due Date. Report High Mileage for a Vehicle.

Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the. State Income Tax Filing Deadline State Estimated Taxes Due Voucher 1 June 5. The second half of real estate tax payments are still due on december 6 2021.

Personal Property Taxes Due Real Estate Taxes Due. The first remittance will be due no later than August 20 2022. Report a Vehicle SoldMovedDisposed.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. The Tax Administration Division is responsible for billing and collecting real estate taxes and associated fees uniformly assessing billing and collecting tangible. Report a Change of Address.

The second half are due by December 5 2022. Report changes for individual accounts. Board Extends Due Date for Real Estate Taxes.

There are several convenient ways property owners may make payments. The 2022 first half real estate taxes were due July 15 2022. August 1 Tax Relief for the Elderly.

Required to be sent at least 14 days after the. When are property taxes due in Virginia County Prince William. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

Effective July 1 2022 any business where food andor beverages are prepared and served to customers must remit a 4 food and beverage tax to the County. Filing is due on or before the 20th of each month for taxes collected the previous month. You will need to create an account or login.

Filing is due on or before the 20th of each month for taxes collected the previous month. Prince william county real estate taxes for the first half of 2020 are due on july 15 2020. June 24 FOR 2022.

The second half are due by December 5 2022. Special Delivery Correspondence express and overnight mail packages and delivery that requires a receipt or signature should be sent to. Personal Property Taxes Due Real Estate Taxes Due.

By mail to PO BOX 1600 Merrifield VA 22116. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance.

The citys carrying out of real estate taxation cannot infringe on the states constitutional regulations. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. Business License Renewals Due.

Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday. Overall all delinquent accounts on a payment plan must be paid in full before the next tax due date. FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or Holiday the due date or deadline is the following business date.

Prince william board of supervisors extends real estate tax payment due date to october 15. By phone at 1-888-272-9829 jurisdiction code 1036. 1 be equal and uniform 2 be based on up-to-date market value 3 have one appraised value and 4 be.

Annually the Board of County Supervisors sets a County-wide tax rate and special district tax rates. Provided by Prince William County. Prince William County Taxpayer Services 1st FL 1 County Complex Court Prince William VA 22192-9201.

The first monthly installment is due July 15th. Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date. Prince william county government virginia.

Taxation of real property must. The second and all subsequent installments are due on the 5th of each month with the final payment being due on June 5th. If you have not received a tax bill for your property and believe you should have contact the Taxpayer Services Office at 703 792-6710 or by email at email protected.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements New 800 Acre Data Center Campus Proposed In Prince William County Virginia Dcd Pathway To 2040 Housing First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living Personal Property Taxes For Prince William Residents Due October 5. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. Prince William County Taxpayer Services PO Box 2467 Woodbridge VA 22195-2467.

The first remittance will be due no later than August 20 2022. During the July 14 meeting the Prince William Board of County Supervisors voted to defer payments for the first half of the real estate taxes.

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

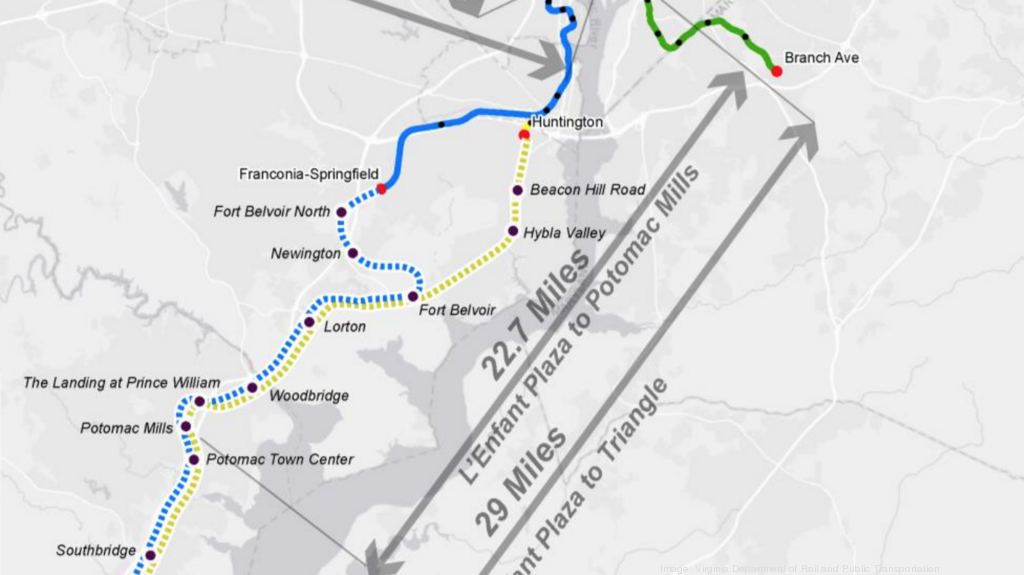

Here S How Metro Would Change Prince William County Development With A Quantico Extension Washington Business Journal

Facility Event Rental The Prince William County Fair

Class Specifications Sorted By Classtitle Ascending Prince William County

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Prince William County Park Rangers New On Call Number Effective April 1 2022

Here S How Metro Would Change Prince William County Development With A Quantico Extension Washington Business Journal

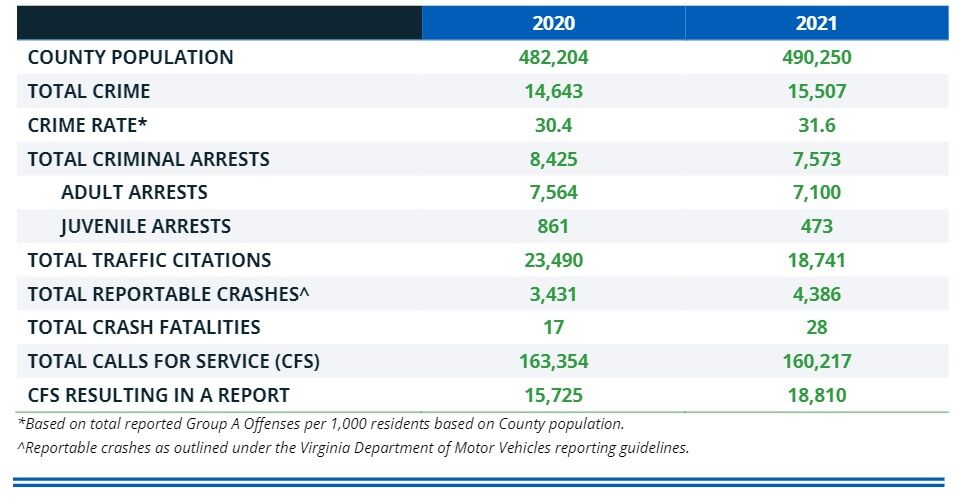

Annual Police Report Details Rise In Crime In Prince William Co Wtop News

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Data Center Opportunity Zone Overlay District Comprehensive Review

Prince William County Housing First Time Homebuyer Program Youtube

Fairfax County Officials Ask Prince William County To Reconsider Pw Digital Gateway Proposals Dcd

How Healthy Is Prince William County Virginia Us News Healthiest Communities